Widely used in optical telecommunication, Short-Wave Infra-Red light sources are key to the development of the imaging market in machine vision, consumer and automotive.

[add_to_cart id=”22051″]

Established Telecom & Infrastructure markets will be joined by SWIR imaging technologies

Players like Sony and STMicroelectronics have recently brought new technologies into the Short-Wave Infra-Red (SWIR) imaging market. These technologies should enable the Industrial market to continue to grow and enter the Automotive & Mobility and Mobile & Consumer emerging markets.

Other companies developing sensors and cameras include New Imaging Technologies (NIT), Trieye Ltd, Emberion, Princeton Infrared Technologies and Sensors Unlimited, contributing to SWIR imaging market growth.

Without sources, there is no imaging market. The SWIR light source market therefore benefits from SWIR imaging market growth.

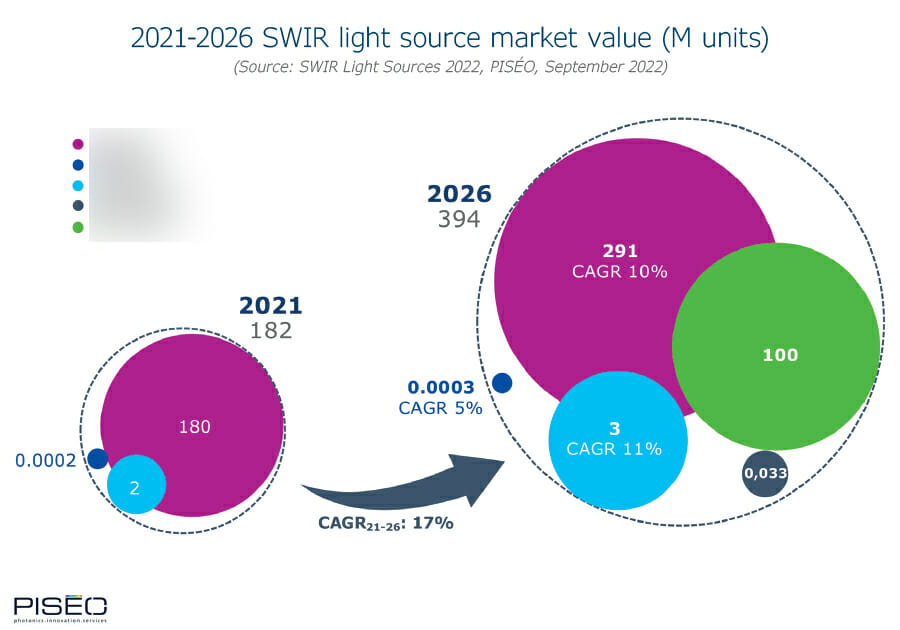

However, the SWIR light source market is currently largely dominated by Telecom & Infrastructure applications, which accounted for 99% of SWIR source unit volumes in 2021.

The SWIR light source market should grow from 182 Munits in 2021 to 394 Munits in 2026 at a 17% Compound Annual Growth Rate (CAGR2021-2026). The Telecom & Infrastructure market will continue to grow but will only be 74% of unit volume in 2026. That’s because, by then, the emerging Mobile & Consumer market will represent 25% of the SWIR source unit volume.

Product portfolio and light source technology analysis: diverse products in a highly dynamic market.

The SWIR imaging market is growing, with most applications needing light sources. As such, players need better understanding of SWIR applications requirements, SWIR light source technologies, and products available on the market, specifically Light Emitting Diodes (LEDs), Edge Emitting Lasers (EELs) and Vertical Cavity Surface Emitting Lasers (VCSELs).

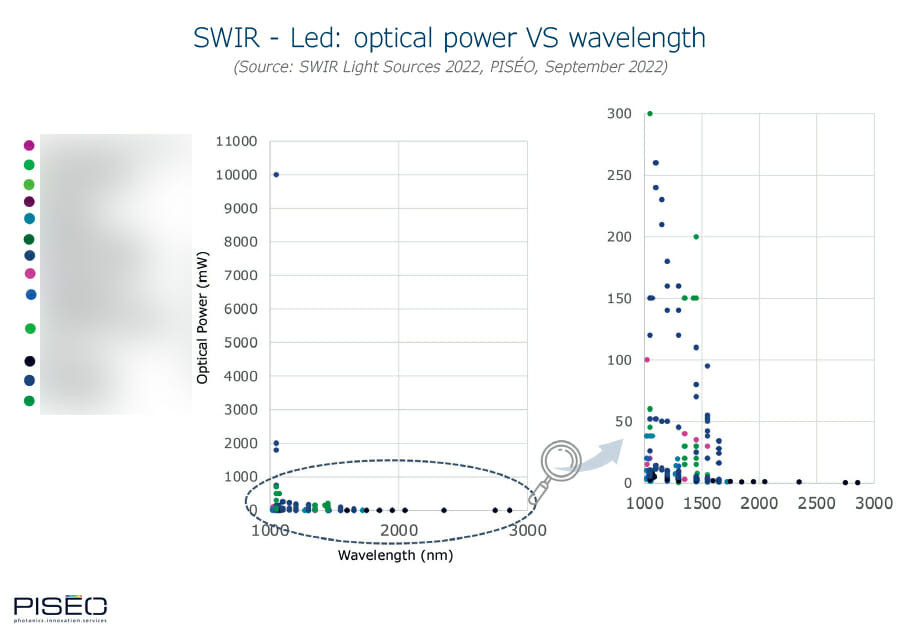

There are hundreds of standard SWIR LED reference products on the market from manufacturers like Ushio, Marktech Optoelectronics, Epigap and Hamamatsu. This market, mainly led by the demand for Industrial applications such as material sorting, is currently looking to reduce costs and increase performance in optical power and wall-plug efficiency.

The offering for SWIR EELs also involves hundreds of standard reference products, with manufacturers like LD-PD Inc., OSI Laser Diode Inc., and II-VI. Most volume originates from the well-established Telecom & Infrastructure market.

Demand and offerings for SWIR VCSELs is currently limited. They should take off with the entrance of SWIR technology into the Automotive & Mobility and Mobile & Consumer markets. Vertilas is a leader in SWIR VCSEL manufacturing, currently mainly addressing gas sensing applications. ams Osram is preparing to enter the market, illustrating the growing interest. Bandwidth10 and LD-PD Inc. are other SWIR VCSELs manufacturers.

There is a strong diversity of requirements in parameters such as wavelength related to different applications. Besides their standard portfolio, most SWIR source manufacturers therefore propose services for custom products.